Growth of Usage-Based Insurance and Telematics Solutions

Usage-based insurance is expanding globally, with technology enhancing insights into driving behaviour, supporting safer roads and sustainable mobility initiatives.

Usage-Based Insurance: Historical Overview and Current Trends

This guide examines the evolution of usage-based insurance, technological advancements, and the benefits for insurers and customers in the context of sustainable mobility.

Telematics Evolution in the Insurance Sector for 2024

Philippe Moulin discusses the advancements in telematics and their implications for insurance models, emphasising smartphone technology's role in enhancing safety and policy management.

Overview of Connected Car Insurance in 2024

The guide examines connected insurance, highlighting its benefits and technologies, including usage-based and behaviour-based programmes for enhanced customer engagement and risk management.

Impact of Eco-Driving on Road Safety Across Different Environments

Research indicates a positive correlation between eco-driving and road safety, particularly in extra-urban and expressway contexts, suggesting implications for insurers in promoting sustainable driving.

Impact of Eco-driving on Environment and Road Safety

The discussion evaluates eco-driving's potential to enhance fuel efficiency and safety, emphasising the role of telematics in promoting sustainable driving behaviours.

Advancements in Connected Insurance Through Telematics

DriveQuant's telematics solutions enhance insurance offerings, enabling insurers to leverage driving data for improved road safety and customer engagement.

Improving Driver Safety Through Smartphone Telematics Data

Technological advances in smartphone telematics are enabling insurers to better assess driving behaviour and manage risk associated with distraction events while driving.

The Role of Beacon Technology in Insurance Solutions

Insurers are leveraging beacon technology with mobile telematics to enhance vehicle identification and short trip detection, offering cost-effective and simplified connected insurance solutions.

Automatic Crash Detection: Enhancements for Insurers

DriveQuant's smartphone-based automatic crash detection improves claim management efficiency and offers timely assistance to policyholders after an accident.

Connected Insurance and Gen Z Driver Safety Challenges

This article explores the impact of connected insurance on enhancing safety among Gen Z drivers, addressing their overconfidence and environmental concerns.

Understanding Automatic Trip Detection in Smartphone Telematics

This article outlines the principles and technology behind automatic trip detection in smartphone telematics, enhancing user experience and driver safety.

Key Considerations for Selecting a Telematics Solution

Evaluating smartphone telematics solutions involves assessing SDK performance, data access methods, technical support, and software documentation to ensure reliability and efficiency.

Star Assurances and DriveQuant Launch STARCONNECT Programme

Star Assurances introduces STARCONNECT, a smartphone telematics programme aimed at enhancing road safety for Tunisian drivers, in partnership with DriveQuant.

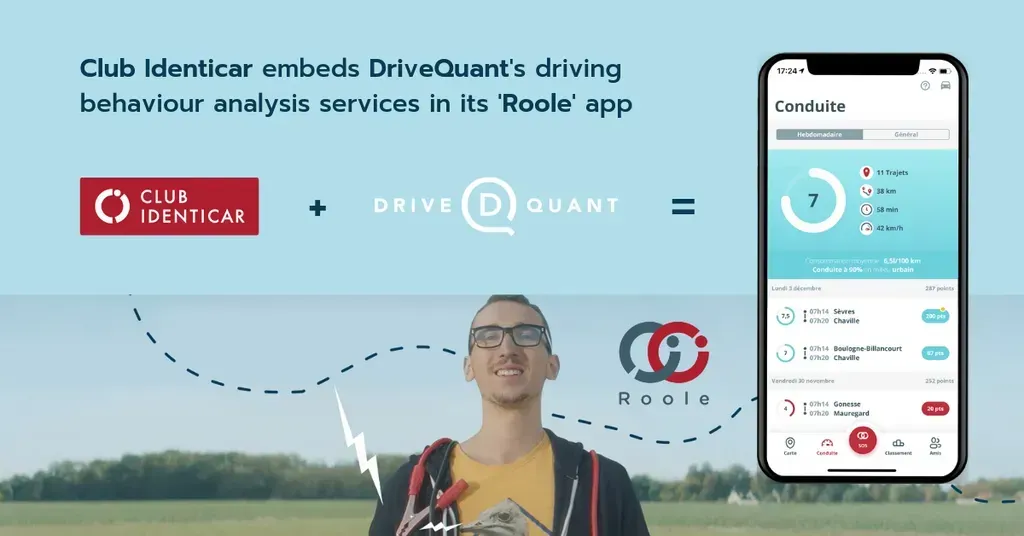

Club Identicar Updates Roole App with DriveQuant Integration

Club Identicar's Roole app now incorporates DriveQuant's driving behaviour analysis, enhancing user support during road difficulties and improving overall journey safety.

Connected Motor Insurance Solutions for Young Drivers in France

Insurers are innovating connected insurance products to enhance pricing models, improve customer trust, and cater to the needs of young drivers in the post-pandemic landscape.

Innovations in Car Insurance Driven by Technology

The evolution of technology in automotive insurance is fostering new business models, with connected insurance promoting tailored premiums based on driving behaviour.

Growth of Mobile Telematics Solutions in Road Safety

Mobile telematics solutions focus on driver behaviour to enhance road safety, utilising community engagement and data analysis to improve driving practices and reduce vehicle maintenance costs.

FairConnect and DriveQuant Form Partnership in Insurance Sector

FairConnect and DriveQuant announce a strategic collaboration to enhance connected motor insurance solutions across Europe, supported by a €5 million investment over three years.

Launch of Wecover by Geco for Car Insurance Savings

Wecover by GECO app assists drivers in improving their skills, offering potential insurance premium reductions through collaborative policies and personalised feedback.

New Location Access Rules in Android 11 and iOS 14

Apple and Google have implemented new user location privacy measures in iOS 14 and Android 11, impacting mobile telematics applications and user data management.

Enhancing Fleet Management with On-board Telematics

On-board telematics solutions are advancing, aiding fleet managers in reducing costs and enhancing employee safety through effective data utilisation.

Launch of World's First Pay Per Minute Auto Insurance Policy

MAIF's subsidiary Altima partners with DriveQuant to introduce a pay-per-minute auto insurance program, targeting occasional drivers with an innovative pricing model.

Overview of Pay-As-You-Drive Insurance Model

Pay-As-You-Drive insurance offers a mileage-based premium system, appealing to cost-conscious drivers and promoting environmentally friendly mobility solutions.

Strategies for Mitigating Distracted Driving Risks

DriveQuant discusses smartphone telematics solutions to detect and reduce distracted driving, benefiting insurers through personalised risk management approaches.

Study Examines Link Between Driving Aggression and Distraction

Analysis reveals a correlation between safety and distraction scores, highlighting the impact of insurer-led prevention campaigns on driving behaviour across different driver groups.

Connected Vehicles and Smartphones in Road Risk Assessment

This article evaluates the effectiveness of connected vehicles and smartphones in measuring road risk, aiding insurers to make informed decisions about connected motor insurance.

Deloitte Discusses Road Risk Prevention Programs for 2024

Deloitte's 2024 report highlights the shift in insurance towards prevention programmes, emphasising digital solutions to enhance customer engagement and mitigate risks effectively.

Telematics Solutions in Car Insurance Enhance Customer Retention

Car insurers are leveraging mobile telematics to adapt pricing models and improve driver behaviour, amidst rising claim costs and customer dissatisfaction.

Groupama Signs Agreement with FairConnect for G-Evolution

Groupama Assicurazioni agrees to sell G-Evolution to FairConnect, enhancing its connected insurance services through a strategic partnership focused on advanced IoT technologies.

TietoEVRY Partners with DriveQuant for Telemetrics Integration

TietoEVRY integrates DriveQuant's telematics into its Insurance-in-a-Box platform, enhancing insurance offerings and enabling rapid market entry for insurers.

DriveQuant Launches DriveKit for Driving Analytics Services

DriveQuant introduces DriveKit, a library offering integrated driving analytics services for automotive and mobility professionals, enhancing data utility across various applications.

Impact of Apple's Crash Detection on Insurance Industry

Apple's new crash detection feature poses opportunities for insurers to enhance mobile telematics services while challenging existing customer relationships in the insurance sector.

DriveQuant Enhances Road Safety Through Data Analytics

DriveQuant utilises smartphone data to optimise driver behaviour, aiming to enhance road safety and improve fuel efficiency across various vehicle types.

DriveQuant Recognised as Leading Insurtech Company

DriveQuant's innovations in telematics aim to enhance road safety and reduce accident risks, supporting insurers and mobility firms in transforming vehicle management.

Mobile Telematics Enhances Car Insurance Risk Assessment

Insurers are leveraging mobile telematics to improve risk assessment and customer retention by basing premiums on actual driving behaviour and risk exposure.

DriveQuant Partners with Companies to Enhance Driving Safety

DriveQuant collaborates with various firms to develop mobile apps focused on improving driving behaviour and reducing road risks through advanced telematics solutions.

DriveQuant Partners With MAIF and Covéa for Mobile Solutions

DriveQuant collaborates with MAIF and Covéa to enhance driver safety through mobile applications leveraging smartphone telematics for insurance solutions.

DriveQuant Launches Smartphone Telematics for Insurance

DriveQuant introduces smartphone telematics solutions to enhance driver safety and minimise environmental impact through advanced data analysis in usage-based insurance.

Rise of Connected Insurance and Customer Retention Strategies

A study indicates significant policyholder attrition in France, prompting insurers to adopt digital tools for innovative connected insurance solutions to enhance customer loyalty.

LB Forsikring and DriveQuant Launch Bilist+ Telemetrics

LB Forsikring and DriveQuant introduce Bilist+, a smartphone telematics programme aimed at enhancing driving safety and reducing accidents in Denmark.

SCOR and DriveQuant Form Strategic Business Alliance

SCOR and DriveQuant have entered a strategic relationship to enhance telematics insurance solutions, focusing on mobility science and real-time data integration.

Impact of Mobile Telematics on Motor Insurance Practices

Mobile telematics technologies enhance risk assessment and driver engagement, offering insurers improved data collection and innovative services to promote safer driving behaviours.

Covéa Launches Driving Analysis App for Young Policyholders

Covéa introduces a driving analysis application to promote safer driving habits among young policyholders, addressing smartphone usage risks while driving.

DriveQuant Introduces LÉA for Enhanced Fleet Safety

DriveQuant has launched LÉA, a mobile app aimed at improving road safety for fleet managers, utilising telematics to analyse driving behaviour and provide real-time feedback.

The Impact of Telemetric Data on Fleet Management Strategies

Fleet management increasingly utilises telemetric data for efficiency and maintenance, with companies like DriveQuant leading innovative practices in smartphone telematics.